168赛车开奖平台入口:1分钟极速赛车一分钟开奖记录168网 VPN Advice You Can Trust

Take control of your internet privacy and security with our unbiased VPN reviews and independent advice.

Who We Are

We Stand for Internet Privacy, Security & Freedom

Our goal is to improve the VPN industry and help you make better decisions about the VPNs you use for a more private, secure, and open internet experience.

VPN Testing & Expertise

Genuine VPN Experts

They oversee the technical aspects of our VPN testing process, conduct the tests themselves, and produce all the reviews and advice published on Top10VPN.com.

Independent Testing

Our VPN recommendations are based on a unique, data-driven methodology that we’ve developed over 30,000 hours of hands-on testing. Our advice is fully independent — we’ll never let a third party influence our ratings.

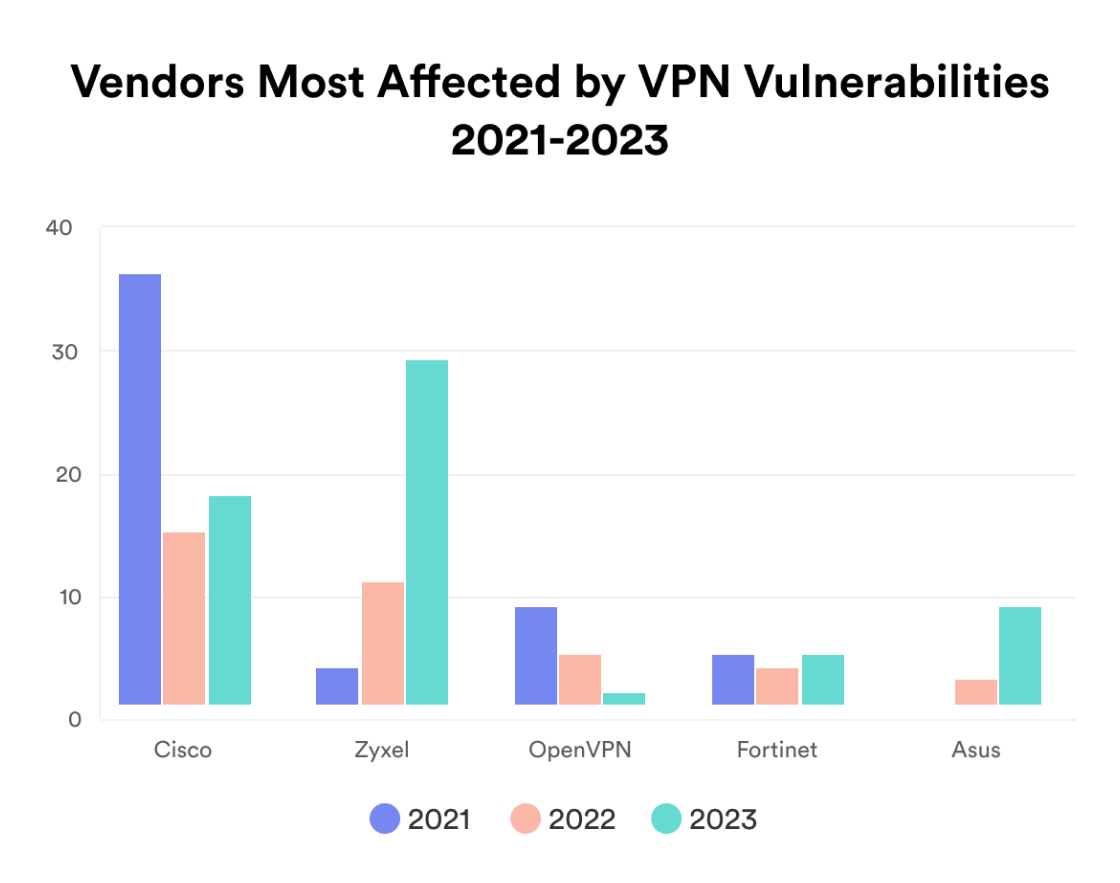

Original Research

We carry out independent investigative research into VPN, digital rights, and security issues. Our work has been covered by the BBC, The New York Times, The Guardian, and more.

Detailed VPN Reviews

极速赛车最新开奖号码,历史记录一分钟赛果 Honest VPN Reviews Based on Real Testing

All 62 VPNs have been reviewed first-hand using our transparent testing process and rating system. By turning complex data into easy-to-understand ratings, we help you quickly find the VPN that best fits your needs.

Bespoke Tools

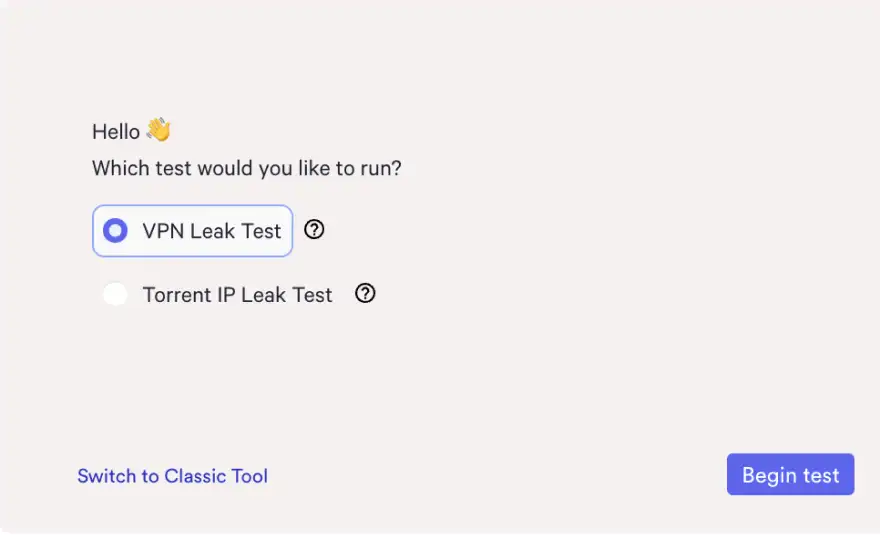

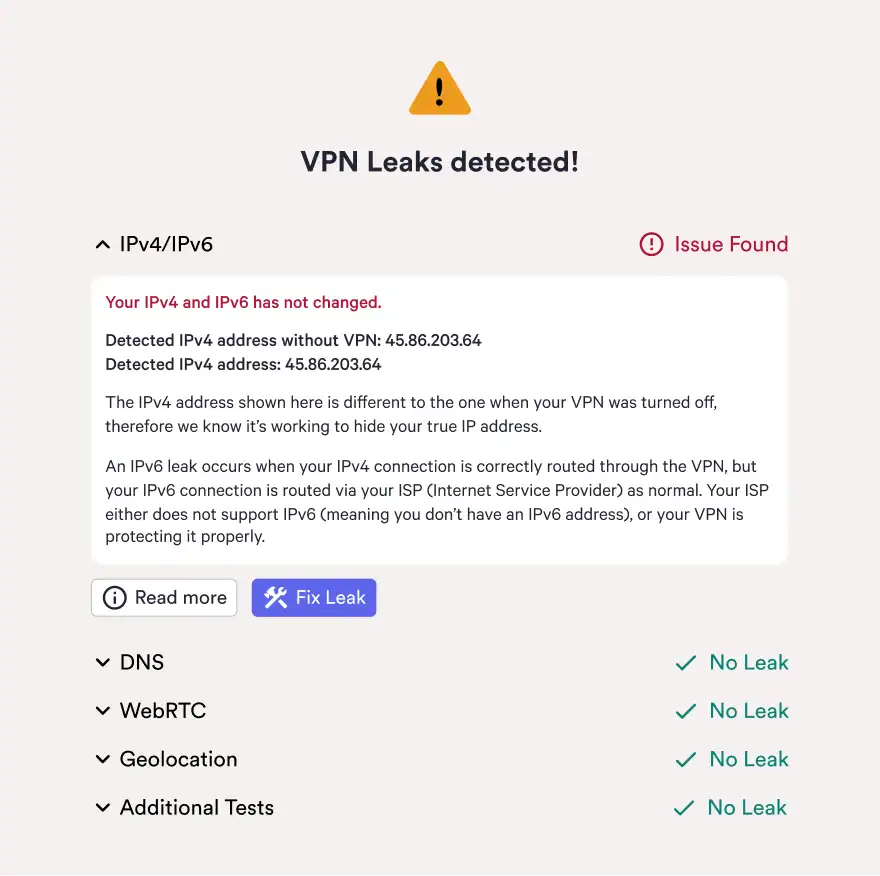

VPN Leak Test

Check if your VPN is hiding your public IP and DNS address correctly in just a few steps.

Bespoke Tools

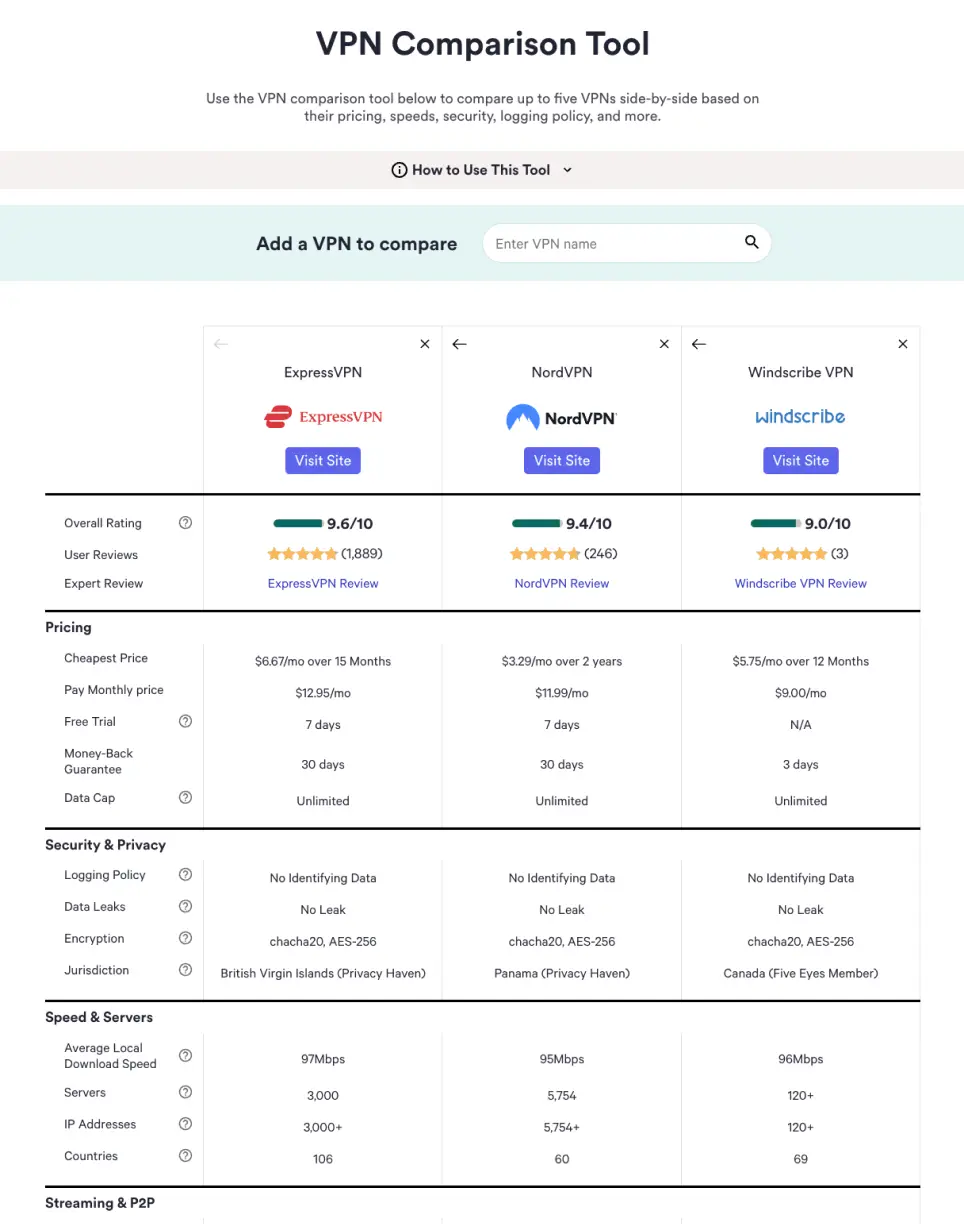

VPN Comparison Tool

Compare the key details of up to 62 popular VPNs, side-by-side.

Guides & Resources

Learn about 168直播,2025极速赛车开奖结果,1分钟官方直播开奖结果,在线看现场开奖视频记录, VPNs

Not sure where to start? Our experts have put together a set of simple, informative guides to help improve your online privacy, security, and freedom.

Our VPN research has featured in over 700 publications